Hotel accounting isn’t just a subsection of general accounting. It’s tailored to meet the specific needs of the hotel industry. This form of accounting enables hotel owners to track and manage their revenue and expenses with pinpoint accuracy. In an increasingly competitive marketplace, successful hotel owners often turn to professional hotel accountants to manage their finances efficiently and make data-driven decisions.

Why hotel accountants are essential

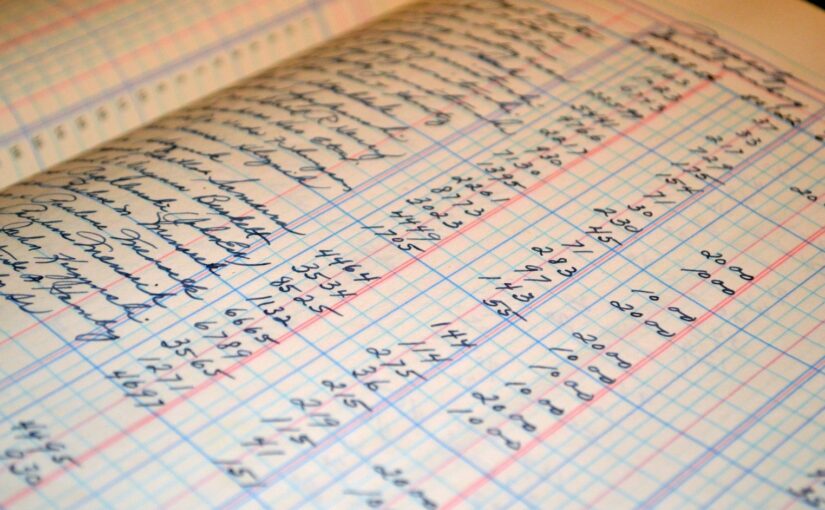

Hotel accounting has its own set of complexities, distinguishing it from other business accounting practices. For instance, considerations include fluctuating costs per room, night auditing, and diverse revenue streams across multiple departments. Hotel accountants excel in managing these factors, offering a detailed overview of a hotel’s financial health at any given time.

Beyond general bookkeeping, hotel accountants maintain up-to-date balance sheets, cash flow statements, and profit-and-loss reports across all departments. They also keep a close eye on specific expenses and inventory, ensuring that accounting practices contribute to a healthy revenue stream.

The importance of accurate hotel accounting

An effective hotel accounting system is essential for several reasons. Firstly, it helps hotel owners make informed decisions backed by reliable data. This system aids in monitoring cash flow, making accurate forecasts, and maintaining annual budgets. It also helps in payroll management and budget planning. What’s more, it ensures that the business stays compliant with tax regulations, helping avoid any potential penalties or issues.

Challenges and solutions in modern hotel economics

The hotel industry faces unique challenges, including erratic cash flow, slim profit margins due to stiff competition, and the need to comply with various legislations. These may include laws related to health and safety, VAT, capital allowances, and minimum wages. On top of that, hotels must compete with platforms like Airbnb, all while striving to maintain customer loyalty and manage labour shortages.

Hotel accountants are well-equipped to navigate these complexities. They can recommend appropriate accounting software and online platforms to streamline operations. Their expertise also ensures that hotels remain compliant with PAYE and VAT regulations, thus minimising potential risks.

Elevate your hotel accounting practices today.

Experience the advantages of impeccable accounting by hiring hotel accountants from Allenby Accountants. We are committed to enhancing your financial practices, enabling you to reap the benefits of accurate and timely accounting. Call 0208 914 8887 to learn more and arrange a no-obligation consultation with one of our chartered accountants.